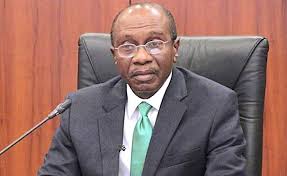

The Central Bank of Nigeria has extended the deadline for the swapping of old naira notes with the redesigned ones till February 10, 2023.

The CBN stated this in a release on Sunday,January 29, 2023.

The apex bank said it added “a 10-day extension of the deadline from January 31, 2023, to February 10, 2023, to allow for the collection of more old notes.”

This was made known in a statement by the CBN governor, Godwin Emefiele.

He also noted that Nigerians would still be able to deposit their old notes directly with the CBN until February 17, 2023, described as “grace period.”

There had been pressure from many Nigerians and groups concerning the initial January 31 deadline for the validity the old notes, as the scarcity of the newly designed 200, 500, and 1000 naira notes prevailed in the country.

Extending the deadline, Emefiele said: “Based on the foregoing, we have sought and obtained Mr President’s approval for the following: a 10-day extension of the deadline from January 31, 2023, to February 10, 2023 to allow for collection of more old notes legitimately held by Nigerians and achieve more success in cash swap in our rural communities after which all old notes outside the CBN loses their Legal Tender Status.

“Our CBN staff currently on mass mobilisation and monitoring together with officials of the Economic and Financial Crimes Commission and the Independent Corrupt Practices and other Related Offences Commission will work together to achieve these objective.

“A seven-day grace period, beginning from February 10 to February 17, 2023, in compliance with Sections 20(3) and 22 of the CBN Act, allowing Nigerians to deposit their old notes at the CBN after the February deadline when the old currency would have lost its Legal Tender status.”

He added: “The Central Bank of Nigeria hasn’t had the opportunity to embark on such currency redesign programme in last 19 years and indeed, let me emphasize that only an incorruptible leader of the President stature can give such approval to the CBN.

“From the onset of this currency redesign program, we made it clear that for 19 years, the CBN hasn’t been able to conduct this important aspect of its mandate, whereas this should normally have been be done within a 5-8 years window.

“Our aim is mainly to make our Monetary Policy Decisions more efficacious and like you can see, we’ve started to see inflation trending downwards and exchange rates relatively stable. Secondly, we aim to support the efforts of our security agencies in combating banditry and ransom taking in Nigeria through this programme, and we can see that the military are making good progress in this important task in Nigeria.

“Available data at the Central Bank of Nigeria has shown that in 2015, currency in circulation was only NI.4 trillion. As at October 2022, currency in circulation had risen to N3.23 trillion; out of which only N500 billion was within the banking industry and N2.7 trillion held permanently in people’s homes.

“Ordinarily, when CBN releases currency into circulation, it is meant to be used and after effluxion of time, it returns to the CBN, thereby keeping the volume of currency in circulation under the firm control of the CBN.

“So far and since the commencement of this programme, we have collected about NI.9 trillion, leaving us with about N900 billion (N500 billion + NI.9 trilIion).

“Based on the foregoing, we have sought and obtained Mr President’s approval for the following:

•A 10-day extension of the deadline from January 31, 2023, to February 10, 2023; to allow for collection of more old notes legitimately held by Nigerians and achieve more success in cash swap in our rural communities, after which all old notes outside the CBN loses their legal tender status. Our CBN staff currently on mass mobilisation and monitoring together with officials of the EFCC and ICPC will work together to achieve these objectives.

“A seven-day grace period, beginning on February 10 to February 17, 2023, in compliance with Sections 20(3) and 22 of the CBN Act, allowing Nigerians to deposit their old notes at the CBN after the February deadline when the old currency would have lost its legal tender status.

“We therefore appeal to all Nigerians to work with the Central Bank of Nigeria to ensure a hitch free process for the implementation of this very important programme. Thank you.”