By

Oludayo Tade

Solutions from other jurisdictions provide useful templates to drive the financial inclusion of the underserved and financially excluded people living with disabilities (PLWD) in Nigeria.

Nigerian banks need to conduct research into the unmet needs of the physically challenged populations who are presently underserved and largely excluded from accessing formal financial services.

Lloyds Banking Group in Britain took this step to understand the unmet needs of customers suffering from dementia. The outcome of the research led to the development of charter on the dementia-friendly financial services.

This is an outstanding step to identify the needs of customers with a view to increasing their access to financial services. This solution driven approach should be embraced by Nigerian banks towards solving the problems of the physically challenged population.

Experiences of PLWDs revealed the dimensions of the barriers to financial inclusion which they face. Akin, for instance, is physically challenged and feels that Nigeria is full of barriers for PLWDs.

He lamented that most banking architectural designs exclude them. “Nigeria is full of barriers. Architectural barriers are all over the place. Most of our public buildings in Nigeria are designed in such a way as to make life more difficult and stressful for persons with disabilities. In other words, persons with disabilities are not usually considered when public buildings are being designed.”

Akin is not alone in this. Bimbola, a civil servant, who also lives with disabilities, explained that she opened her bank account because it was a condition for her to be paid her salary. “If not for the salary I received through bank, I would not have had a bank account. The reason is that banks in Nigeria are not built to be accessed by persons with disabilities.

“Someone on crutches, for instance, cannot access the Automated Teller Machine (ATM) because of the structure that will require the person to climb steps. If such person also wants to enter the banking hall, there are steps to climb. Besides, tiled floor in the banking hall could cause crutches to slip,” she said.

On another note, Yinka disclosed how technology impedes his access to the banking hall. He said, “I do not have access to the banking hall because of the security doors. Even If I have difficulty with the ATM, I will not be allowed to enter. Rather I will be attended to outside the banking hall by some bank staff.

Although they have been meeting my needs, I am not satisfied with such arrangement as I am always under the scorching sun waiting for whoever handles my case to come out of the banking hall. I believe I have right to enter to enjoy facilities like air conditioner and toilet provided out of the profits realized from my transactions.”

Although the security doors are for the protection of staff, money and facilities from armed robbers, PLWDs like Yinka, feel bank facilities should be peculiar to the unique characteristics of customers.

Many PLWDs are also reportedly denied access to financial loans although those gainfully employed have better experiences than others. Bimbola, for instance, has received a bank loan. She said, “I had got a bank loan before. This, I believe, was possible because I am a civil servant. Such access could not have been there if I wasn’t a civil servant because the bank might think persons with disabilities were too poor to refund loans.”

Visually impaired Ade decided not to request for an ATM card because not all bank galleries are disability friendly. He said, “For someone like me with physical limitation, I cannot gain physical access to the ATM. So, I would have to depend on some other people for transactions performed with the ATM card. This would be like taking unnecessary risks. Ade considers his decision a rational safeguard against fraud. “I do not possess an ATM card. I was advised to do away with it. Even though it is convenient using it, the gains associated with it are lesser than the costs for someone like me who cannot see.”

Bank Staff disclosed that the visually impaired are advised against taking ATM card in order not to compromise their personal identification numbers (PINs) and be defrauded. Although PLWDs globally face barriers but steps to address these problems has been encouraging in India. With about 66million PLWDs, India is addressing the challenges of financial inclusion of PLWDs with development of assistive technologies (AT).

Assistive technologies make the environment, products and services easily accessible to PLWDs. Common ones being used are text and image magnification for the visually impaired, audio and tactile technologies for the blind and the deaf.

In the same vein, Nigerian banks could deploy screen magnifiers, Braille display/keyboards, and speech synthesizers to drive financial inclusion of PLWDs.

Banks could also install ramps on all ATMs and Braille keypads on at least one machine in a gallery to assist PLWDs.

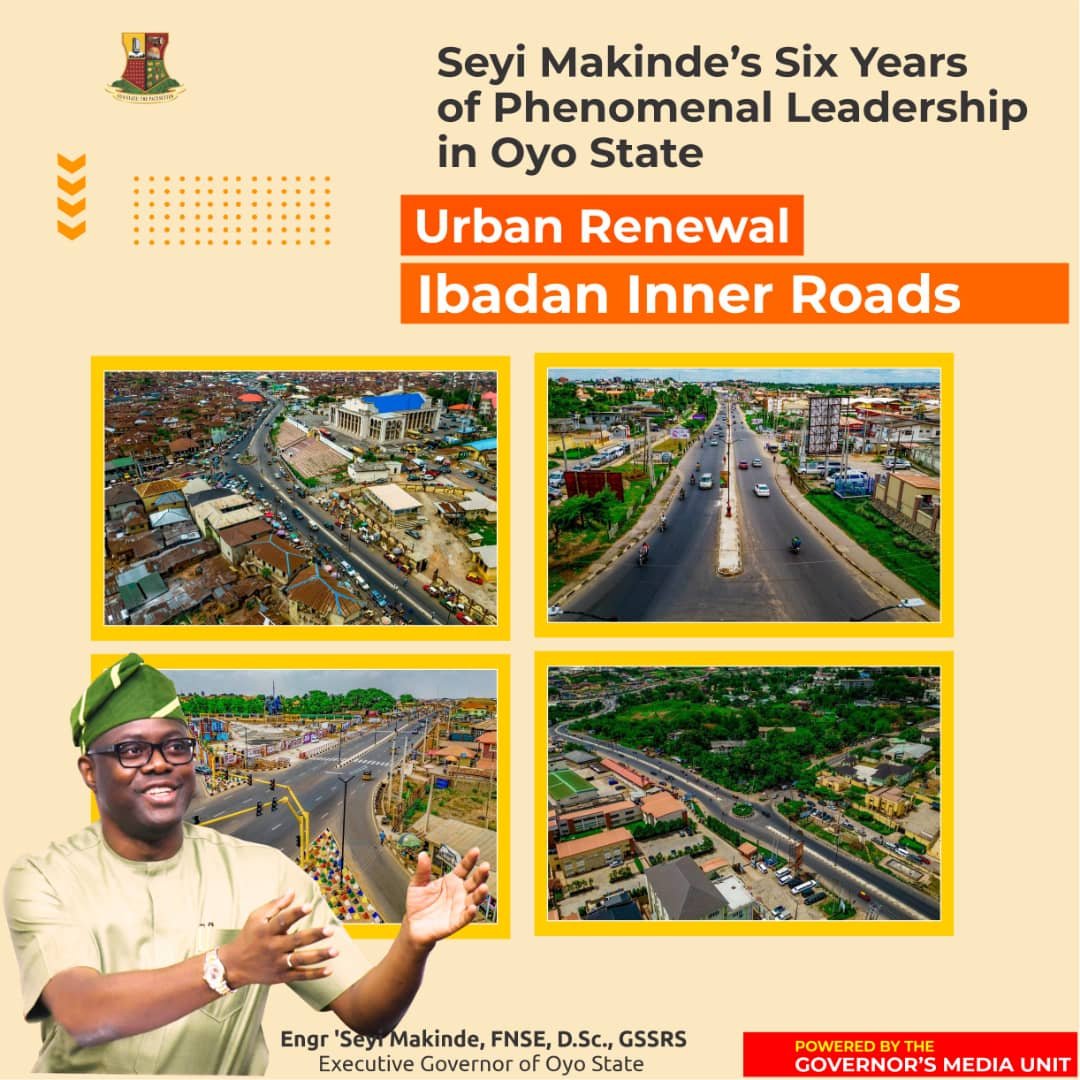

In its 2019 Rule Book, the Central Bank of Nigeria (CBN) mandates Deposit Money Banks (DBM) “to provide opportunity for increased access to its products and services through platforms such as cash centres, e-branches, and mobile money and increasing efficiency to serve more clients. A Bank should consider making its physical locations and facilities accessible to physically challenged persons.”

Despite this policy intervention, PLWDs continually suffer unpleasant experiences accessing banking services. They are excluded by disability-unfriendly structures and are made to endure exclusionary financial services. Yet PLWDs constitute untapped goldmine for banks to retain sizeable share of the banking market and grow their organisations.

Underestimating the buying power of the physically challenged population in Nigeria will be to the detriment of DBMs.

According to the Martin Prosperity Institute, the purchasing influence power of people living with disabilities is expected to exceed $1trillion in the United States by the end of 2021. This is a possibility for the Nigerian economy if embraced but why should we drive the financial inclusion of PLWDs?

According to the World Health Organisation, over one billion people globally live with one form of disability or another with 190million of them within 15 years and above bracket. In Nigeria, there are about 25million PLWDs and close to 40million persons are financially excluded. The Nigeria Inter-Bank Settlement System PLC reported that there are about 124.85million bank accounts opened in Nigeria. Out of these, 45.57million are dormant. What this tells us is that there is a largely untapped market of PLWDs by banks and not doing so affects the life chances of this underserved vulnerable social group who operate at the margins of financial inclusion.

While people living with disabilities (PLWD) in urban centres face financial exclusion, the experiences of their counterpart in the rural areas which house over fifty percent of Nigerians is better imagined than experienced. Capturing PLWD in formal financial services will make them save, invest, access loans and contribute to the growth of the economy, according to experts.

To address the problem of disability unfriendly structures, the CBN must ensure that banks’ architectural designs are disability-friendly and that their financial services accommodate all forms of disabilities. The government also has a major role to play to ensure that it enforces the provisions of the Discrimination against Persons with Disabilities (Prohibition) Act of 2018 which provides five-year transition of modification of public buildings, structures and automobiles to make them accessible and usable for persons living with disabilities.

Dr Tade, sociologist and solution journalist wrote via dotad2003@yahoo.com